Preqin Awards Methodology

Preqin's proprietary methodology showcases the top and most consistent industry performers.

Private Capital Performance

Eligibility requirements

Asset class level

-

Fund profile must be visible on Preqin Pro.

-

Fund profile status must be ‘Active’.

-

Fund Manager must have raised funds in that asset class over the last 7 years.

-

Fund Manager must have a minimum of 5 funds with quartile ranking for that asset class.

-

Fund Auditor must be tagged for the manager.

Strategy level

-

Fund profile must be visible on Preqin Pro.

-

Fund profile status must be ‘Active’.

-

Fund Manager must have raised funds in that strategy over the last 7 years.

-

Fund Manager must have a minimum of 3 funds with quartile ranking for that strategy.

-

Fund Auditor tagged for the manager.

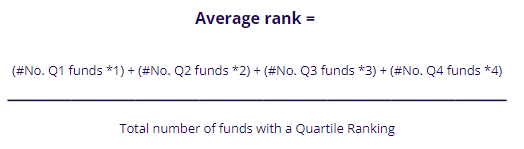

Ranking criteria

-

Sort average rank for each fund manager by lowest to highest.

-

Lowest average rank will be determined and the winners and will move to review stage.

Data review process

-

Winners and shortlisted funds were identified to perform a final review of all relevant data points on firm and fund profiles, in addition to attempted direct outreach with each Fund Manager to confirm data accuracy.

-

For all Private Capital Performance Preqin Awards, the aim was to verify the following:

-

Fund auditor tagged to the fund profile

-

Fund strategy

-

Fund raised in the last 7 years

-

Performance metrics: Called%, DPI%, RVPI%, Net IRR

-

Private Capital Fundraising

Eligibility requirements

Fundraising Series Growth

-

Fund closed in 2022

-

3rd fund or later in the fund series

-

Predecessor minimum fund size of USD 40 million except for Venture Capital

First-Time Fundraising

-

Fund closed in 2022

-

Identified as the first fund of the Fund Manager to complete fundraising

Data analysis

-

For the Fundraising Series Growth award, the percent fund size growth of the 2022 closed fund was analyzed against its predecessor.

-

For the Largest First-time Fundraise award, the largest first-time funds closed by asset class were identified.

Data review process

-

Winners and shortlisted funds were identified to perform a final review of all relevant data points on firm and fund profiles, in addition to attempted direct outreach with each Fund Manager to confirm data accuracy.

-

For the Fundraising Series Growth award, the aim was to verify the following:

-

Fund closed in 2022

-

Fund final size and predecessor final size

-

Fund auditor

-

-

For the Largest First-Time Fundraise award, the aim was to verify the following:

-

Fund closed in 2022

-

First fund raised

-

Fund auditor

-

FAQ

When was the performance data pulled?

-

Performance data was pulled from Preqin Pro on May 31, 2023.

What was the time frame for consideration?

-

A fund would meet eligibility requirements if the performance data was reported as of the last five quarters (from March 2022 to March 2023).

Was there a fee required to participate in the Preqin Awards?

-

No, all firms and funds that met eligibility requirements were considered for the Preqin Awards free of charge.

Additional questions?

Reach out to Preqin's private capital performance team.

Preqin Awards are compiled using public domain information and data reported to Preqin by the participants; they are not independently verified or assessed.

Preqin cannot therefore guarantee the accuracy of the information provided. Details of Preqin’s proprietary methodologies can be found for private capital and for hedge funds.

If you intend to refer to your standing in marketing materials, you may only do so if you repeat the above statement within the materials.

The information provided is updated and corrected from time to time, so please ensure you check our service for the most recent data.